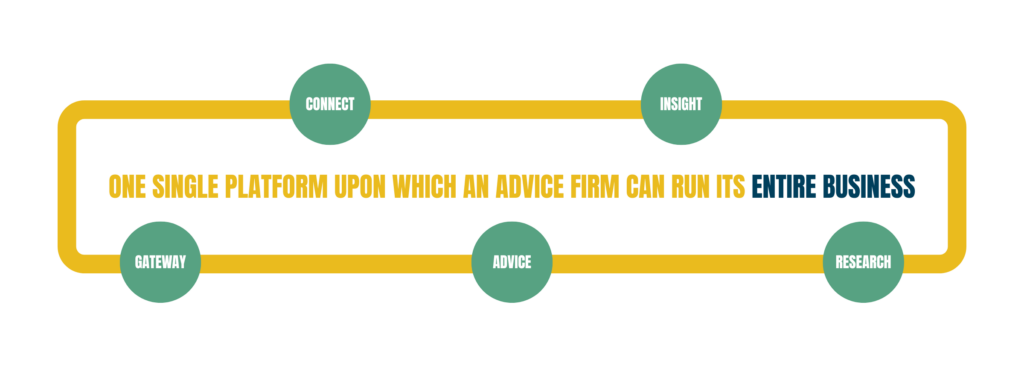

We’ve designed a platform that unifies every part of the advice process into a single, intelligent ecosystem. From lead generation and client engagement to sourcing, compliance and case management, our tools are seamlessly integrated to help mortgage, wealth, and protection intermediaries thrive.

Access real-time product and lender data in one place. Our intelligent filters and integrations help you quickly find the best product recommendations, ensuring your clients get the right solution with minimal effort for mortgage sourcing, protection , life and general insurance quotes.

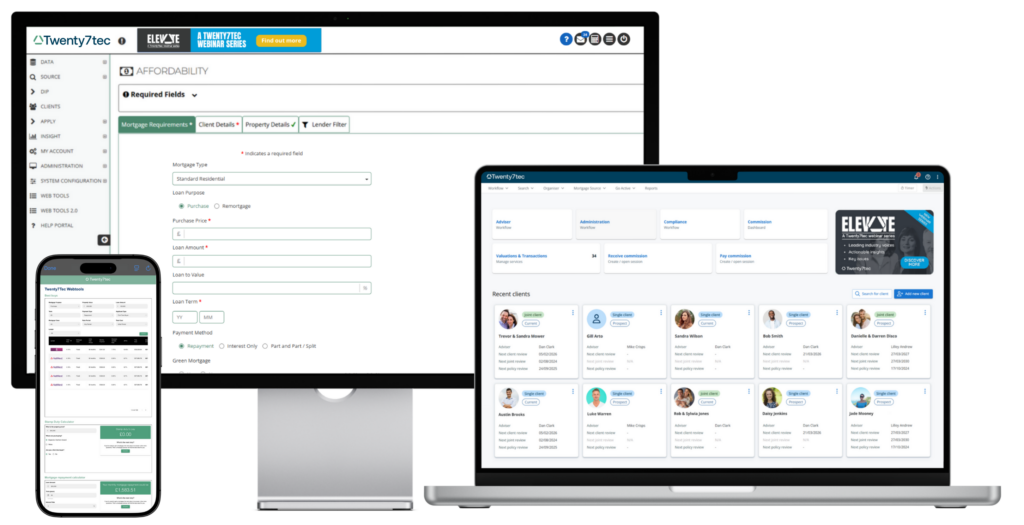

Our mortgage product search tool combines product availability, affordability checks and lender criteria – helping you deliver compliant, appropriate recommendations every time.

Our CRM connects the dots between clients, cases, communications and compliance. Our CRM reduces manual data entry, enhances team collaboration, and ensures every interaction is tracked and recorded for compliance purposes.

Our suite of B2C tools are designed to help advisers and firms attract, qualify, and nurture leads more effectively. Whether you’re embedding simplified product sourcing on your website, using real-time affordability checks to filter and educate customers, or building fully bespoke digital journeys with our B2C API, our solutions puts advisers at the centre of a smarter, self-serve experience – all while protecting the value of advice. It’s the ideal solution for firms ready to scale, streamline and stand out in the digital marketplace.

Engage clients more effectively, convert more leads, and nurture long-term relationships.

Streamline processes across all aspects of your business, reducing administration and maximising productivity.

Easily meet regulatory needs with built-in compliance features across sourcing, CRM and data tools.

Our platform is built to integrate all aspects of the advice process, ensuring that your teams can work more efficiently and effectively, drive more client engagement and stay ahead of the competition without having to use multiple systems.

Our B2C website tools create a seamless digital journey for clients to self-serve, qualify for products and engage with your brand. Increase lead flow and customer acquisition with minimal effort.

Our solutions helps you engage clients and prospects across mortgage, wealth, and protection sectors. Generate leads and drive conversions through a unified digital presence that amplifies your brand’s visibility.

Get a holistic view of performance with integrated reporting and analytics. Track client outcomes, adviser activity, and business metrics in real time, so you can make smarter, data-informed decisions for growth.

Our intelligent ecosystem is designed to help you grow your business, improve efficiency, and ensure compliance — all in one unified platform.